Many of us are up for renewal this year & it can be overwhelming deciding what to do as the market and interest rates have drastically changed since the beginning of your mortgage term. As always, I never recommend taking the first rate your lender offers at time of renewal. The market is still competitive and there are likely much better options available when it comes to interest rates and mortgage terms. I’ve listed a few other things to consider before simply renewing with your current lender. Reach out anytime to discuss your options

-

Mortgage Balance

Click Here To Read The Full Article

-

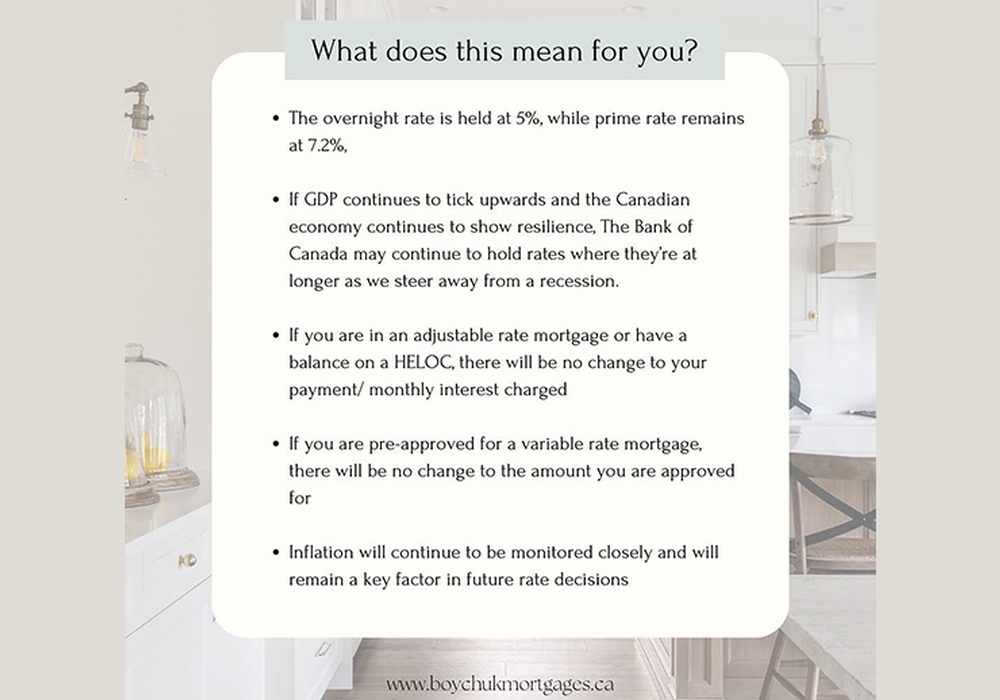

Bank of Canada Update: No change to the policy interest rate

As expected the Bank of Canada held its key overnight interest rate at 5%. This is the sixth consecutive hold since July 2023 following a decrease to core inflationary numbers and a jump in unemployment. With the housing market continuing to heat up, the Bank of Canada is vague to signal when rate cuts will begin. However, assuming we maintain downward momentum to inflation, most economists are predicting that we may see a 0.25 bp decrease as early as June, bringing the rate back down to 4.75% with continuing rate decreases throughout 2024 and 2025. The next Bank of Canada rate…

Click Here To Read The Full Article

-

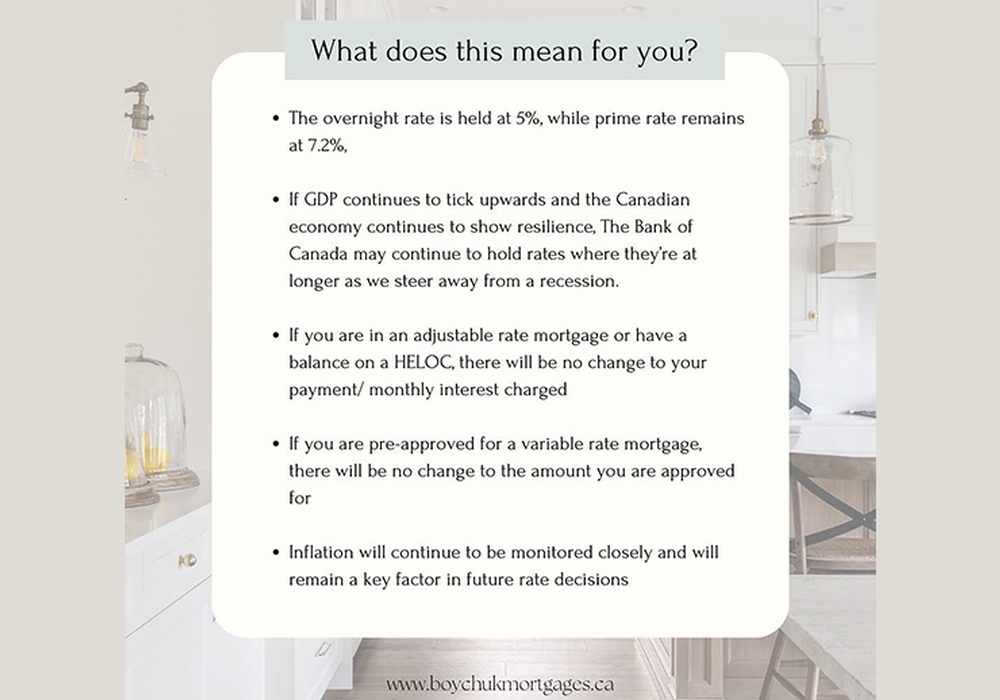

What does this mean to you?

✨As we were expecting, the Bank of Canada has held the prime rate at 7.2%. ✨

The Bank of Canada has maintained its policy interest rate since July 2023. We saw slightly stronger than expected economical growth this last quarter. However, with Inflation continuing to mildly move towards the 2% target, many economists are anticipating rate decreases to begin in the latter half of the year.

Click Here To Read The Full Article

-

Private Mortgages

Private mortgages are a great option for anyone that falls outside the traditional lending guidelines, or for anyone that needs a quick close on their property.

They differ from conventional mortgages as they tend to be shorter terms, with higher interest rates, and often with additional fees.

Click Here To Read The Full Article

-

Navigating Mortgage Lenders

Purchasing a home is a significant financial decision, and the mortgage process can be overwhelming. Choosing the right lender and mortgage product can have a significant impact on your financial future. With various mortgage lenders and products available in the market, navigating the mortgage process can be a daunting task. That's where an independent mortgage advisor comes in - to help you make informed decisions and guide you through the mortgage process.

Click Here To Read The Full Article

-

Buying vs Renting

Are you currently contemplating whether to buy or rent a property? This decision can be a daunting task, especially when you consider the various factors that come into play. Owning a home comes with a sense of pride and accomplishment, but it also requires a significant investment. On the other hand, renting offers flexibility and requires fewer upfront costs, but it comes with its limitations. In this blog post, we will be discussing the pros and cons of buying and renting to help you make an informed decision.

Click Here To Read The Full Article

-

Early Mortgage Renewal Guide

Mortgage renewals can be a stress-inducing process, but with a bit of planning and strategy, you can save thousands of dollars. Here's a guide to help you make an informed decision when renewing your mortgage.

Click Here To Read The Full Article

-

2024 Real Estate Outlook

As we enter the new year, it's essential to understand the potential game-changers for BC real estate in 2024. Despite the ever-changing landscape, we can still make some predictions to navigate the uncertainty. This blog will cut through the noise and delve into some of the most critical factors affecting BC real estate in 2024.

Click Here To Read The Full Article

-

Porting Your Mortgage

What to know about porting a mortgage & why this is a smart financial move right now…

- Porting your mortgage involves moving your current mortgage over to a new property.

- It’s likely that your current interest rate on your home is lower than what is available today, so this is a great way to save.

Click Here To Read The Full Article

-

Bank of Canada Update: No change to the policy interest rate

Well some good news! The Bank of Canada has decided to pause rate hikes. This is following a reported decline to GDP, core inflation lowering slightly, and increasing unemployment rates, suggesting a softening economy. This is good news for variable rate mortgage holders, and anyone with lines of credit.

Click Here To Read The Full Article

-

Gross Domestic Product

GDP in simple terms is the total value of goods and services produced in a specific time frame. It is the main measure used to evaluate how healthy our economy is.

Click Here To Read The Full Article

-

Unemployment raise rise for the 3rd consecutive month

With another Bank of Canada rate announcement scheduled for the first week of September, it’s important to understand some of the other factors besides inflationary tracking that influences the decision to raise, lower, or hold interest rates.

Click Here To Read The Full Article

-

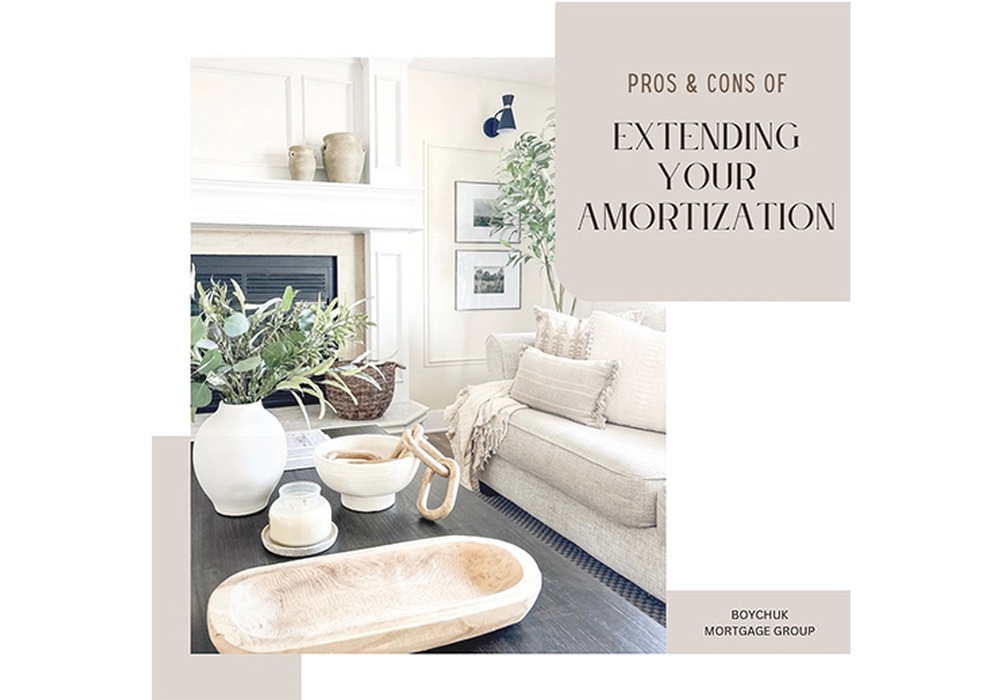

Pros & Cons of Extending Your Amortization

Because interest rates have risen rapidly over the past year, if you are up for renewal you may have heard of people choosing to extend their mortgage amortization period to 30 years.

Click Here To Read The Full Article

-

Inflation Update

Inflationary numbers came in higher for July at 3.3% than the previous months report of 2.8%.

We saw the most significant increases to energy categories with electricity coming in 11.7% higher than a year ago. We also saw very minimal changes to gasoline prices. Likewise, mortgage interest costs and accommodation continues to lead inflationary increases.

Click Here To Read The Full Article

-

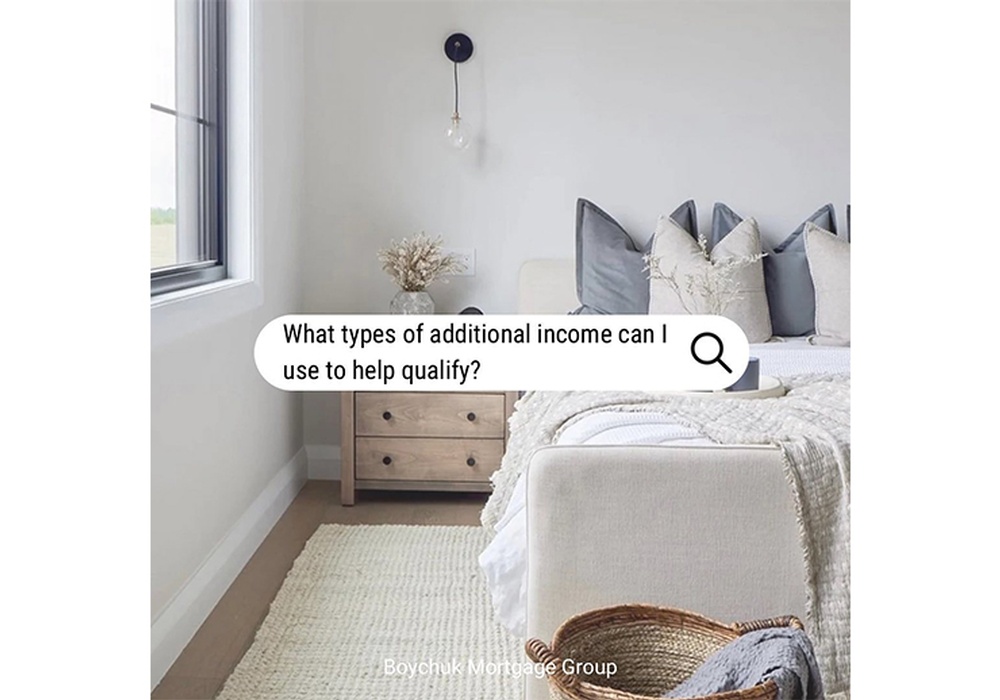

What types of additional income can I use to help qualify?

When purchasing or refinancing in a market with higher interest rates, you may find it more challenging to qualify for the amount you originally had planned for. However, there are many lenders out there that will consider a variety of different income sources other than your employment income.

Here is a quick reminder of the different types of income you can use:

Click Here To Read The Full Article

-

Inflation Update: Canadian inflation drops down to 3.4% for May

Canadian inflation has slowed to 3.4% from the April’s previous report of 4.4%. This is the lowest inflation has been in almost two years. However, much of this decrease can be attributed to fuel and energy costs being significantly lower than this time last year when we saw a spike in energy prices resulting from the Ukraine/ Russian war. Mortgage interest costs also continue to heavily influence inflation with an increase of 29.9% over the last year. We continued to see increases to categories including restaurant food, while grocery prices have remained elevated with no sign of any notable changes from April. Although this…

Click Here To Read The Full Article

-

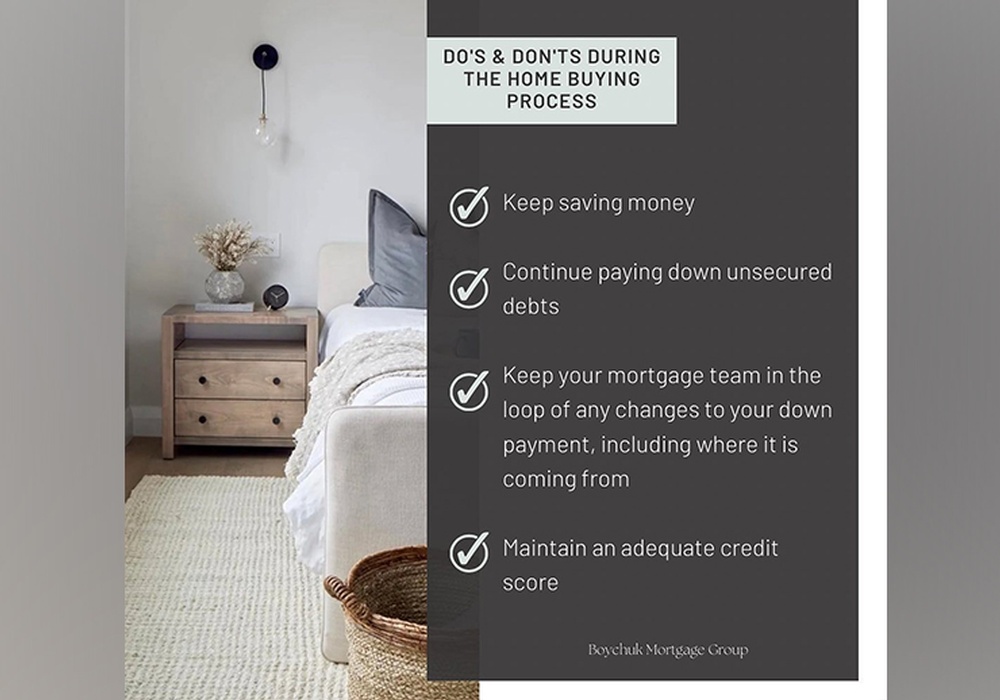

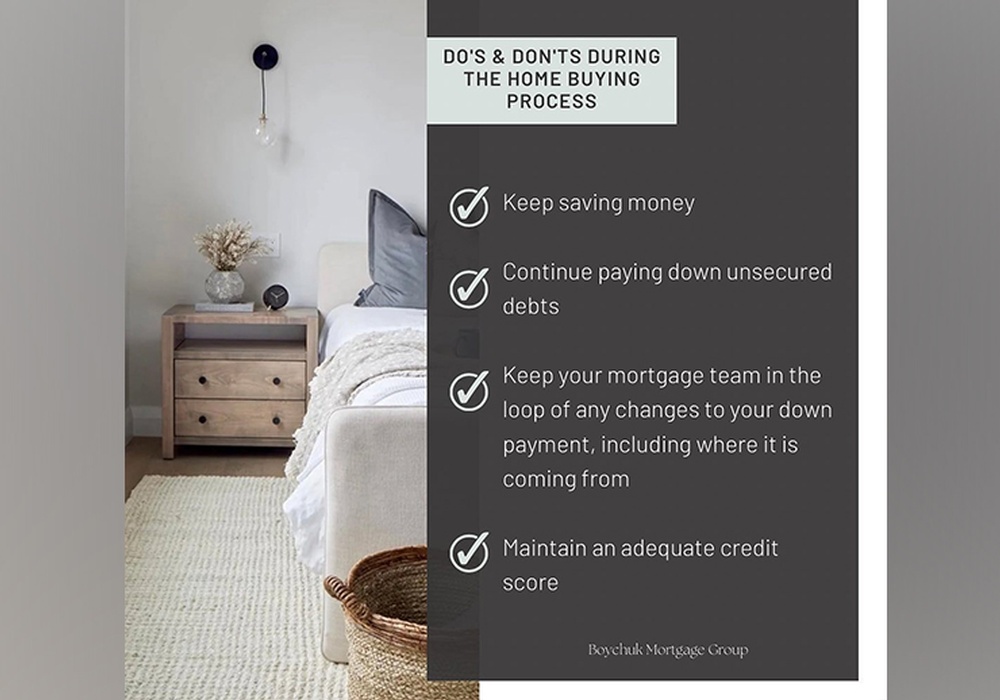

Do's & Don'ts during the home buying process

Just a reminder if you are pre-approved or thinking about starting that house hunting journey. 🙂

Click Here To Read The Full Article

-

What you should know about applying for a mortgage on a strata property

It’s recommended that your offer should be subject to viewing various strata documents

A form B will be required by your lender from the last 30 days. This form confirms the current state of the strata including any outstanding levies or special assessments as well as how much money is in the contingency fund.

Click Here To Read The Full Article

-

Inflation Drops to 4.3%

More good news! ⭐️

Inflationary numbers for March came in at 4.3%. This is down from the 5.2% we saw the month prior.

Click Here To Read The Full Article

-

Multi Generational Home Tax Credit

The government of Canada has introduced a Multi-Generational Home Tax Credit

Click Here To Read The Full Article